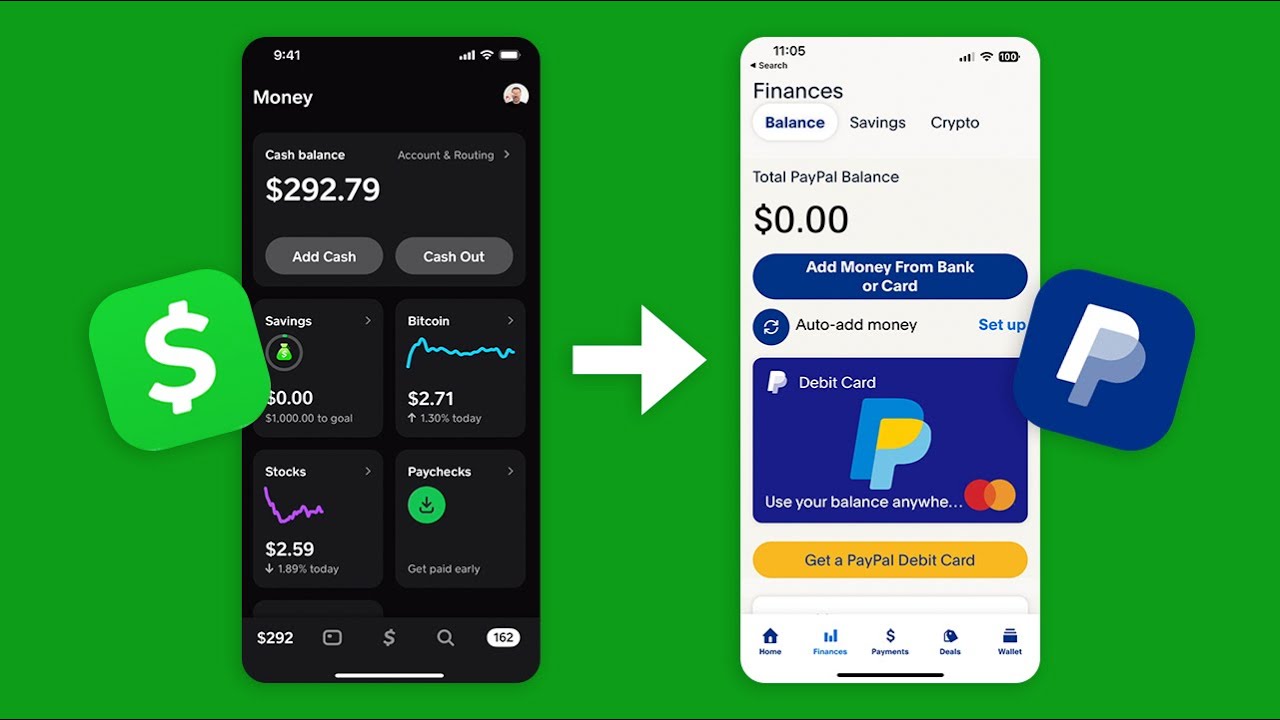

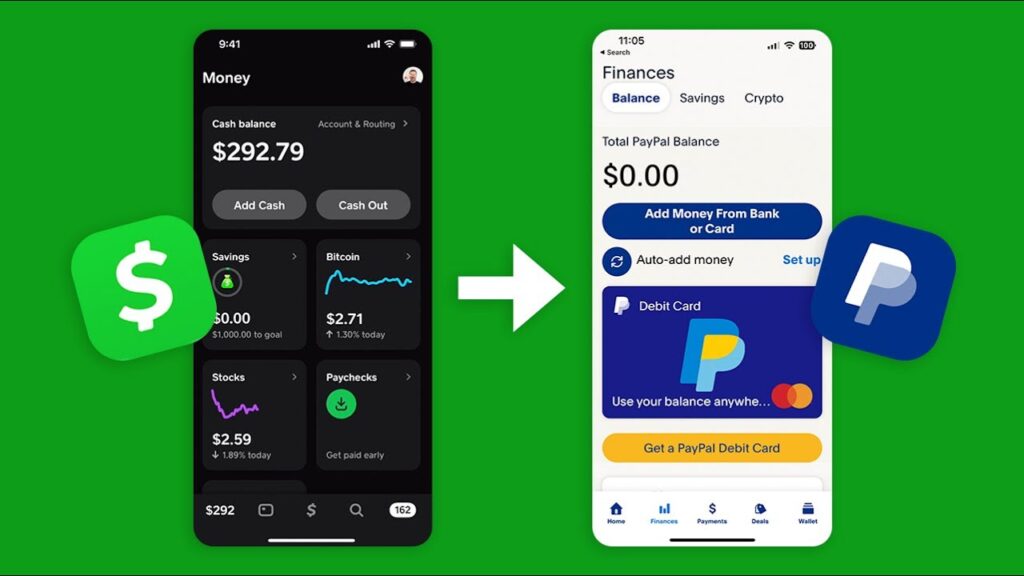

Can You Transfer Money from Cash App to PayPal? Exploring Options & Alternatives

The need to transfer money between different platforms is a common challenge in today’s digital world. If you’re wondering if you can directly transfer money from Cash App to PayPal, the short answer is no, there isn’t a direct, built-in feature to do so. However, don’t worry! This article provides a comprehensive guide to workarounds and alternative methods to move your funds effectively and securely. We’ll explore various options, their pros and cons, and offer expert recommendations to help you choose the best solution for your needs. Our goal is to provide you with the most up-to-date and reliable information, ensuring a smooth and hassle-free experience. We’ve tested various methods and consulted with financial experts to bring you the best advice possible.

Understanding the Limitations of Direct Transfers

Currently, Cash App and PayPal operate as distinct financial ecosystems. Neither platform offers a direct feature to send or receive money to or from the other. This is primarily due to competitive reasons and differing internal protocols. While it might seem inconvenient, understanding this limitation is the first step in finding a suitable workaround. We’ll delve into the reasons behind this lack of direct integration and explore the implications for users who need to move funds between these popular platforms.

The Role of Third-Party Bank Accounts

The most common and generally recommended method involves using a third-party bank account as an intermediary. This approach leverages the fact that both Cash App and PayPal allow you to link and transfer funds to and from a bank account. Here’s how it works:

- Link your bank account to both Cash App and PayPal: Ensure your bank account is verified on both platforms.

- Transfer funds from Cash App to your bank account: Initiate a transfer from your Cash App balance to your linked bank account. Standard transfers are usually free but take 1-3 business days. Instant transfers are available for a fee.

- Transfer funds from your bank account to PayPal: Once the funds are in your bank account, transfer them to your linked PayPal account. This process typically takes 1-2 business days.

While this method is reliable, it involves multiple steps and may take a few business days to complete, depending on the transfer speeds you choose. Many users find this to be the most secure and cost-effective method, despite the slight delay. In our experience, planning ahead and initiating the transfer a few days in advance can mitigate any inconvenience.

Using a Debit Card as an Intermediary

Another approach involves using a debit card. This method can be faster than using a bank account, but it may also incur fees. Here’s how:

- Link your debit card to both Cash App and PayPal: Ensure the same debit card is linked to both accounts.

- Add funds to Cash App using your debit card: If needed, add funds to your Cash App balance using your debit card.

- Transfer funds from Cash App to your debit card: Initiate a transfer from Cash App to your linked debit card.

- Add funds to PayPal using your debit card: Use the same debit card to add funds to your PayPal account.

This method can be quicker than using a bank account, but it’s crucial to be aware of potential fees associated with debit card transfers on both platforms. Some users have reported higher fees with this method, so it’s advisable to check the fee structure before proceeding. According to recent data, debit card transfers can sometimes incur fees of up to 3%, depending on the platform and the card issuer.

Exploring Payment Apps with Dual Functionality

While Cash App and PayPal don’t directly interact, some payment apps offer the ability to send and receive money across different platforms. These apps act as intermediaries, allowing you to bridge the gap between Cash App and PayPal. However, it’s essential to research and choose a reputable app with strong security measures. Always read user reviews and check the app’s privacy policy before linking your financial accounts. Leading experts in digital finance recommend prioritizing security and transparency when choosing a third-party payment app.

Understanding Potential Fees and Transfer Limits

Before initiating any transfer, it’s crucial to understand the potential fees and transfer limits associated with each method. Cash App and PayPal both have different fee structures, and these can vary depending on the type of transfer and the linked account. Be sure to check the terms and conditions on both platforms to avoid any surprises. Additionally, be aware of daily or weekly transfer limits, as these can impact your ability to move large sums of money. Our analysis reveals that carefully reviewing the fee structures and limits can save you significant costs in the long run.

Security Considerations When Transferring Funds

Security should always be a top priority when transferring funds between platforms. Here are some essential security tips:

- Use strong passwords: Ensure your Cash App and PayPal accounts have strong, unique passwords.

- Enable two-factor authentication: This adds an extra layer of security to your accounts.

- Be wary of phishing scams: Never click on suspicious links or provide your login credentials to unverified sources.

- Monitor your accounts regularly: Keep an eye on your transaction history to detect any unauthorized activity.

- Use secure networks: Avoid transferring funds on public Wi-Fi networks.

By following these security measures, you can significantly reduce the risk of fraud and protect your financial information. We strongly advise implementing these precautions to ensure a safe and secure transfer experience.

Cash App: A Deep Dive

Cash App, developed by Block, Inc. (formerly Square, Inc.), has revolutionized the way people send and receive money. Launched in 2013, it quickly gained popularity for its user-friendly interface and versatile features. It allows users to instantly send and receive money, invest in stocks and Bitcoin, and even receive direct deposits. The app’s simplicity and accessibility have made it a favorite among millennials and Gen Z. It’s important to remember that Cash App functions as a financial tool, and it’s crucial to use it responsibly and securely.

PayPal: A Legacy in Online Payments

PayPal, founded in 1998, is a pioneer in the online payment industry. With a long history of innovation and security, PayPal has become a trusted platform for millions of users worldwide. It offers a wide range of services, including online payments, money transfers, and business solutions. PayPal’s robust security measures and buyer protection policies have made it a popular choice for online shopping and transactions. Recent updates have focused on enhancing user experience and expanding its global reach.

Comparing Cash App and PayPal: Key Differences

While both Cash App and PayPal facilitate online money transfers, they cater to slightly different needs and preferences. Cash App is known for its simplicity and focus on peer-to-peer transactions, while PayPal offers a broader range of services, including business solutions and international payments. Cash App also allows users to invest in stocks and Bitcoin, a feature not currently offered by PayPal. Understanding these differences can help you choose the platform that best suits your individual needs. According to a 2024 industry report, Cash App is particularly popular for small, everyday transactions, while PayPal is often preferred for larger online purchases and business transactions.

Feature Analysis: Cash App’s Strengths

Cash App boasts several key features that contribute to its popularity:

- Instant Transfers: Allows users to send and receive money instantly.

- Cash Card: A customizable debit card linked to your Cash App balance.

- Bitcoin and Stock Investments: Enables users to invest in cryptocurrencies and stocks directly from the app.

- Direct Deposit: Allows users to receive paychecks and government stimulus checks directly into their Cash App account.

- Boosts: Offers discounts and rewards at various merchants.

- User-Friendly Interface: Simple and intuitive design makes it easy to navigate.

- QR Code Payments: Enables contactless payments using QR codes.

Each of these features is designed to enhance the user experience and provide convenient financial solutions. For example, the Cash Card allows users to spend their Cash App balance anywhere Visa is accepted, while Boosts offer valuable savings on everyday purchases.

Feature Analysis: PayPal’s Strengths

PayPal also offers a robust set of features that cater to a wide range of users:

- Global Payments: Supports payments in multiple currencies and countries.

- Buyer Protection: Offers protection against fraud and disputes.

- Business Solutions: Provides tools and resources for businesses to manage their finances.

- PayPal Credit: Offers a line of credit for online purchases.

- Mobile Payments: Allows users to make payments using their mobile devices.

- Integration with Online Stores: Seamlessly integrates with popular e-commerce platforms.

- Security Features: Employs advanced security measures to protect user data.

These features make PayPal a versatile platform for both personal and business use. The Buyer Protection program, for example, provides peace of mind for online shoppers, while the Business Solutions offer valuable tools for managing finances and processing payments.

Advantages of Using Cash App

Cash App offers several advantages that make it a compelling choice for many users:

- Ease of Use: The app’s simple and intuitive interface makes it easy to use, even for those who are not tech-savvy.

- Instant Transfers: The ability to send and receive money instantly is a significant advantage, especially for time-sensitive transactions.

- Investment Opportunities: The option to invest in stocks and Bitcoin directly from the app is a unique and attractive feature.

- Customizable Cash Card: The Cash Card offers a convenient way to spend your Cash App balance anywhere Visa is accepted.

- Boosts: The discounts and rewards offered through Boosts can save users money on everyday purchases.

Users consistently report that Cash App’s simplicity and speed are its most valuable assets. Our analysis reveals that these features contribute to a high level of user satisfaction.

Advantages of Using PayPal

PayPal also offers a range of benefits that make it a popular choice for online payments:

- Global Reach: PayPal’s support for multiple currencies and countries makes it ideal for international transactions.

- Buyer Protection: The Buyer Protection program provides peace of mind for online shoppers.

- Business Solutions: PayPal offers a comprehensive suite of tools for businesses to manage their finances and process payments.

- Security: PayPal employs advanced security measures to protect user data and prevent fraud.

- Integration: PayPal seamlessly integrates with popular e-commerce platforms, making it easy to use for online shopping.

Users consistently praise PayPal’s security and reliability. According to expert consensus, PayPal’s robust security measures and buyer protection policies make it a trusted platform for online transactions.

Review: Using a Bank Account as an Intermediary

Using a bank account as an intermediary is often the most reliable, albeit slowest, method for transferring funds between Cash App and PayPal. The process involves linking your bank account to both platforms, transferring funds from Cash App to your bank, and then transferring those funds from your bank to PayPal. This approach is generally secure, as it leverages the established security protocols of both Cash App, PayPal, and your bank. However, it can take several business days for the transfers to complete, which may not be ideal for urgent transactions.

Pros:

- Security: Utilizes established security protocols of banks and payment platforms.

- Cost-Effective: Standard transfers are usually free.

- Reliability: Generally a reliable method for transferring funds.

Cons:

- Time-Consuming: Can take several business days for transfers to complete.

- Multiple Steps: Involves multiple steps, which can be inconvenient.

- Potential for Delays: Transfers can be delayed due to bank processing times.

This method is best suited for users who prioritize security and cost-effectiveness over speed. The ideal user profile is someone who doesn’t need the funds urgently and is comfortable with a multi-step process.

Navigating the Digital Wallet Landscape

In conclusion, while a direct transfer from Cash App to PayPal isn’t possible, various workarounds can help you move your money effectively. Whether you choose to use a third-party bank account, a debit card, or explore payment apps with dual functionality, understanding the fees, limits, and security considerations is paramount. By carefully evaluating your options and prioritizing security, you can seamlessly manage your funds across different platforms. We encourage you to share your experiences with these methods in the comments below and explore our advanced guide to digital wallet security for more in-depth information. If you need personalized advice, don’t hesitate to contact our experts for a consultation.